Routely® overview

Auto insurers, do you need a better way to effectively measure and quantify risky driving behaviors?

Our Routely® app enables you to capture telematics data while creating a brand-specific experience for your customers. Here’s how.

Our mobile app can help you identify and manage risk in your book of business, improve the customer experience, and coach users to form safer driving habits.

Our Routely® app enables you to capture telematics data while creating a brand-specific experience for your customers. Here’s how.

Implement a branded telematics program either as a standalone app or via SDK into your existing policyholder app in as quickly as 8-10 weeks.

Your customers install the Routely® app on their smartphone, enter the activation code linking the app to their policy, and automatic trip capture is enabled.

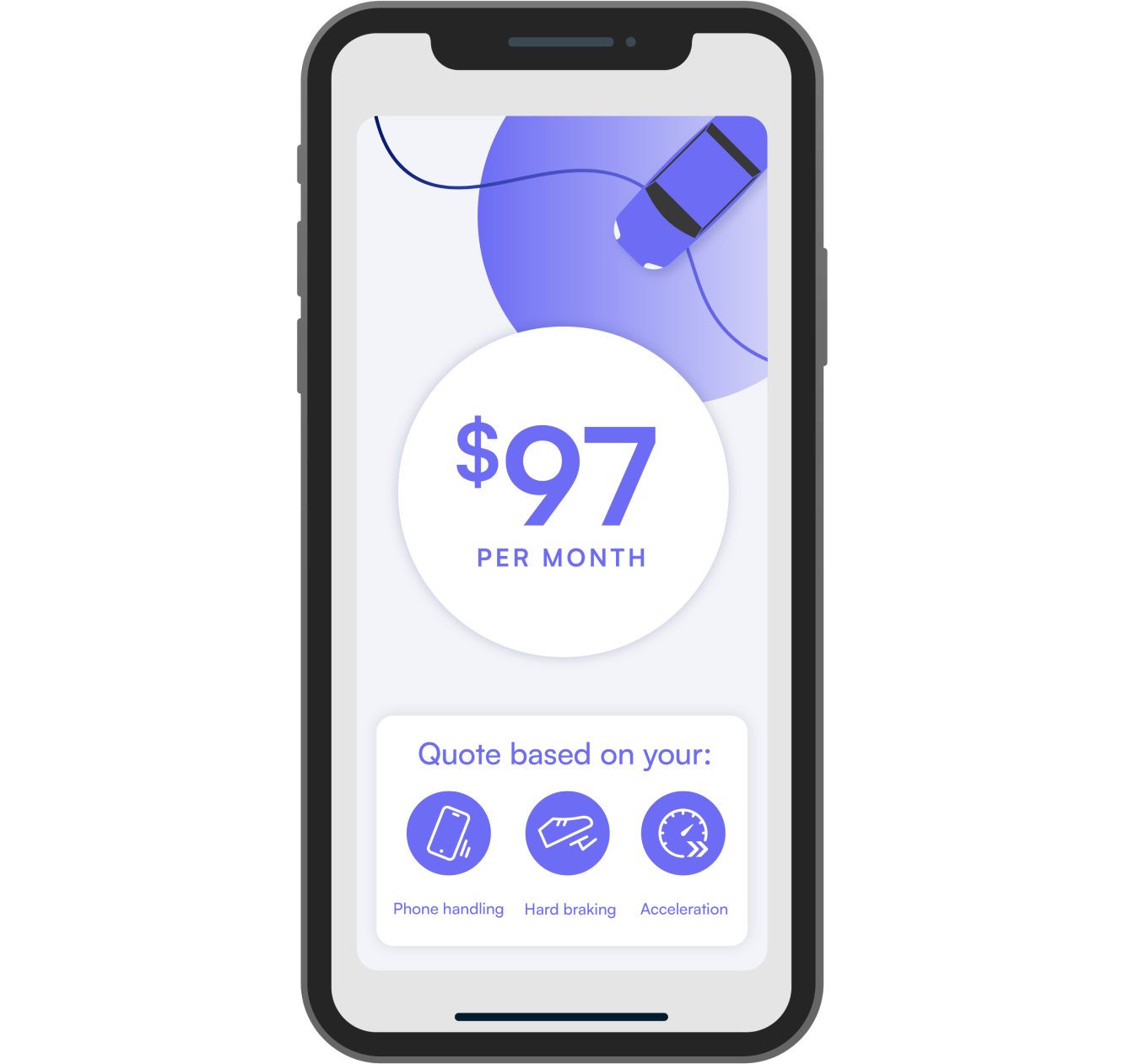

Routely® delivers personal insights to your customers to help them become safer behind the wheel.

Leverage our most predictive scoring model: Drivesight®. Better match price to risk and provide personalized pricing while lowering loss ratios.

Find out what our customers at National General and Southern Farm Bureau have to say about our Routely® app.

Leveraging our Routely® app and Drivesight® driving score, National General launched its branded telematics program quickly and effectively.

Arity helped Southern Farm Bureau Casualty Insurance Company (SFBCIC) launch an innovative telematics program to encourage safer driving.