Arity at AIR 2024: Latest driving trends’ impact on auto insurance Read article

Carriers are dealing with one of the most difficult periods in auto insurance history. And even though it’s showing improvements as we kick off the new year, profitability remains strained as we’re not expected to see combined ratios approaching 100% before 2025.

However, as industry challenges start to “soften,” now is the time for carriers to flip the script. Here are six trends impacting auto insurance profitability, along with how carriers can overcome them in 2024.

Consumers are understandably growing more and more agitated with today’s auto insurance rates. Not only did we see high levels of shopping and switching last year, but some people were pushed to forego their coverage altogether.

With consumer sentiment already at an all-time low, carriers should rethink their sole reliance on “rate-hiking” when it comes to improving profitability. While it may help the bottom line, it’s only a short-term solution that can ultimately hurt carriers in the long run.

As we move forward, carriers may want to focus on figuring out who truly deserves rate hikes – and who deserves a break in their rising premiums. Driving behavior data can enable this pricing sophistication strategy, helping to segment customers based on how risky or safe their driving behaviors are.

There’s an ongoing issue within the industry, with areas across the U.S. (like parts of California and Florida) becoming “uninsurable” due to extreme weather and climate risks. While these challenges may have started in the home insurance side, it’s ultimately impacting other forms of personal property coverage – including auto insurance. Many carriers are pulling business out of these areas entirely due to tightened underwriting rules.

These “insurance deserts” are making it even more difficult for consumers to access affordable insurance options.

The size of cars and trucks in the U.S. has continued to rise since 2008 – and unfortunately, this has contributed to the increased risk on our roads.

From a safety standpoint, vehicles with a hood greater than 40 inches high are 45% more likely to cause fatalities than shorter vehicles. Not only are they more likely to result in head or neck injuries from striking at a higher point, but they also tend to have less driver visibility.

In addition to this increase in vehicle size, there’s also been an increase in vehicle speed. From 1990 to 2021, the average new vehicle horsepower has grown by 87% while acceleration (time to get from 0-60 MPH) has grown by 33%.

From an insurer’s financial risk POV, these heavier, faster cars tend to cause more damage when an impact occurs which means higher claims costs. These issues are likely to persist, especially with carmakers focusing on converting their most popular vehicles – pickup trucks and crossovers – into EVs.

Vehicle size is only one factor impacting the risk on our roads. In the past 10 years, traffic deaths have risen 30%, and a lot of that can be attributed to an increase in risky driving behaviors.

Distracted driving, as one example, increased by more than 30% from 2019 to 2022, which has resulted in 10,000 fatalities and more than one million nonfatal injuries each year. As commuting makes its comeback, auto frequency will likely continue to rise which leaves auto insurance carriers even more vulnerable to today’s profitability challenges.

However, carriers can take matters into their own hands and combat this risk with driving behavior data. For example, in 2020, Southern Farm Bureau Casualty Insurance Company (SFBCIC) partnered with Arity to launch its telematics program, DriveDown. Through coaching and incentives for safe driving behaviors, SFBCIC helped over 20% of its drivers reduce their distracted driving by more than 50% in just 30 days.

This is a win-win. Insurers who motivate behavior change not only improve their bottom line by reducing risk (and therefore, claims costs), but they also play an active role in keeping their customers safe on the roads.

Competition is growing in the auto insurance industry, with car manufacturers like Tesla and GM offering their own embedded insurance during the car-purchasing process – and several others considering partnering with legacy carriers to offer this option as well.

However, this new approach to insurance hasn’t come without its growing pains as Tesla is facing a class action lawsuit from customers claiming they were overcharged for their premiums.

Regardless, with some customers (particularly Gen Zs and Millennials) preferring the convenience of embedded insurance, it’s going to be even tougher for carriers to retain customers in this period of high shopping and switching.

Speaking of competition, it’s clear that some carriers are overcoming these profitability challenges faster than others. And it’s those that acted earlier to get ahead of these trends, by cutting costs and getting the right rate into the right markets, that are coming out on top.

Carriers that are struggling should look for solutions that can help them “catch up” and supercede competitors. For one, carriers can leverage the world’s largest driving behavior database tied to claims to price more profitably with the Arity IQ℠ network. With access to a person’s driving score at time of quote, these carriers can offer good drivers the best rate – giving them a strong competitive advantage to win new business.

Carriers that are already ahead of the game should look for ways to stay ahead. For those that have already boosted (or are planning to boost) their advertising budgets, Arity Audiences can help them reach their best customers based on how, when, and where they drive. For example, Arity’s lowest-risk tier drivers have up to 5x greater lifetime value (LTV) than average drivers which means investing in this segment can help carriers grow profitability long-term.

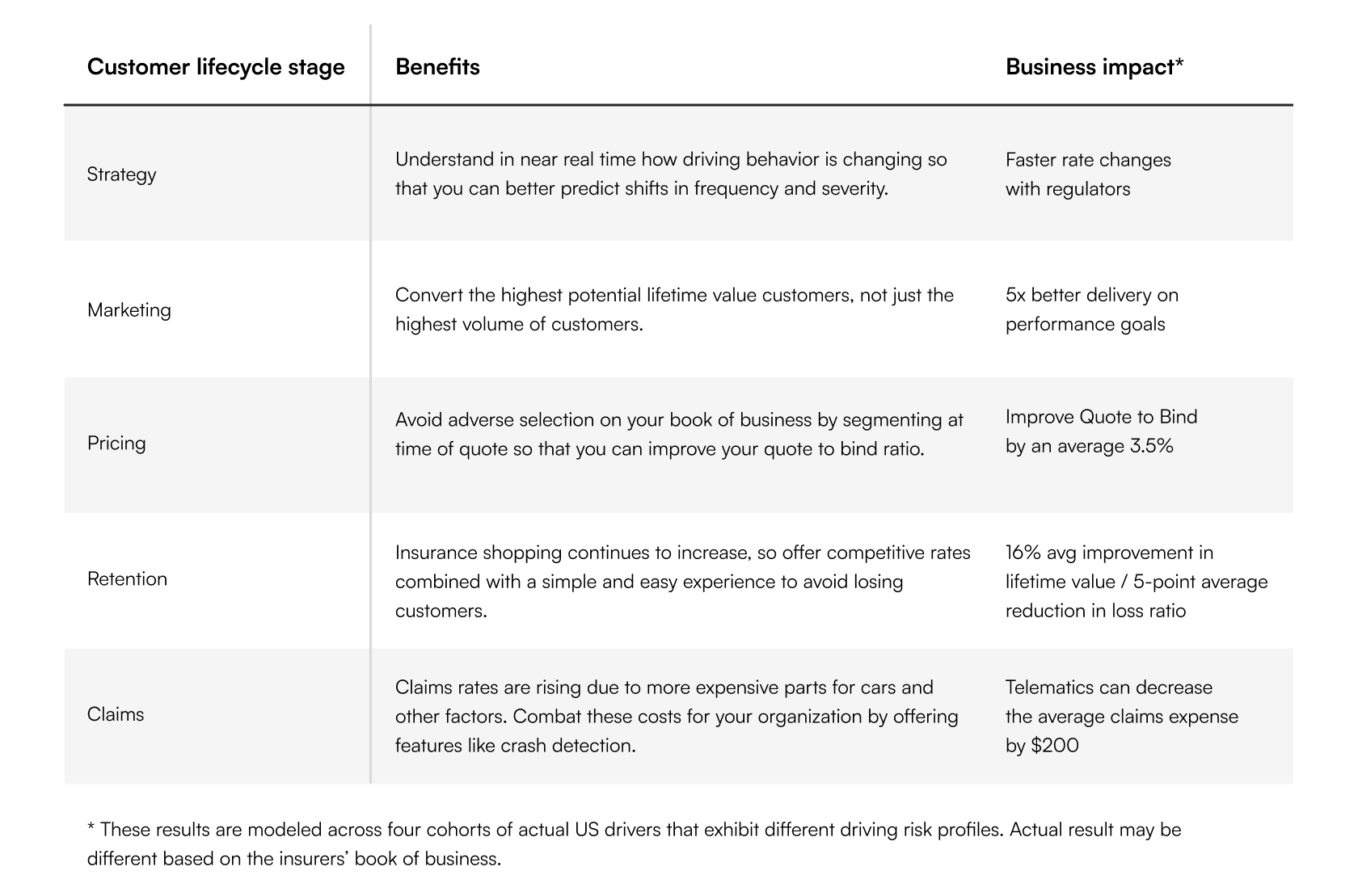

Arity helps carriers increase profitability across the entire auto insurance value chain – from strategy all the way to claims – with access to driving behavior data on over 40 million drivers.

Are you ready to return to profitability in 2024? Connect with our team to learn how our solutions can work for you!