Protecting drivers: Auto insurance and the future of mobility Read article

Read the first post in this series.

At a time when economic forces present the auto insurance industry with extremely difficult challenges, the right telematics tools can improve pricing sophistication and drive profitability. To understand the scope of the current challenges, you only need to look at the financial numbers in the preliminary 2022 AM Best report.

Roughly 75% of U.S. auto insurers have experienced a higher combined loss ratio in 2022 versus 2021. The vast majority of them have experienced an increase of up to 25 points in their combined loss ratio. That’s a massive increase in just a 12-month period. On average, the combined ratio of these auto insurers is now close to 108%, which means that between rising loss ratios and expense ratios, they’re paying out more money in claims than they are receiving from premiums.

For auto insurers who are attempting to turn things around in an economy that’s seeing both high inflation and increased consumer shopping for better premiums, something must be done. The question is how and where to begin? Auto insurance telematics supplies multiple benefits:

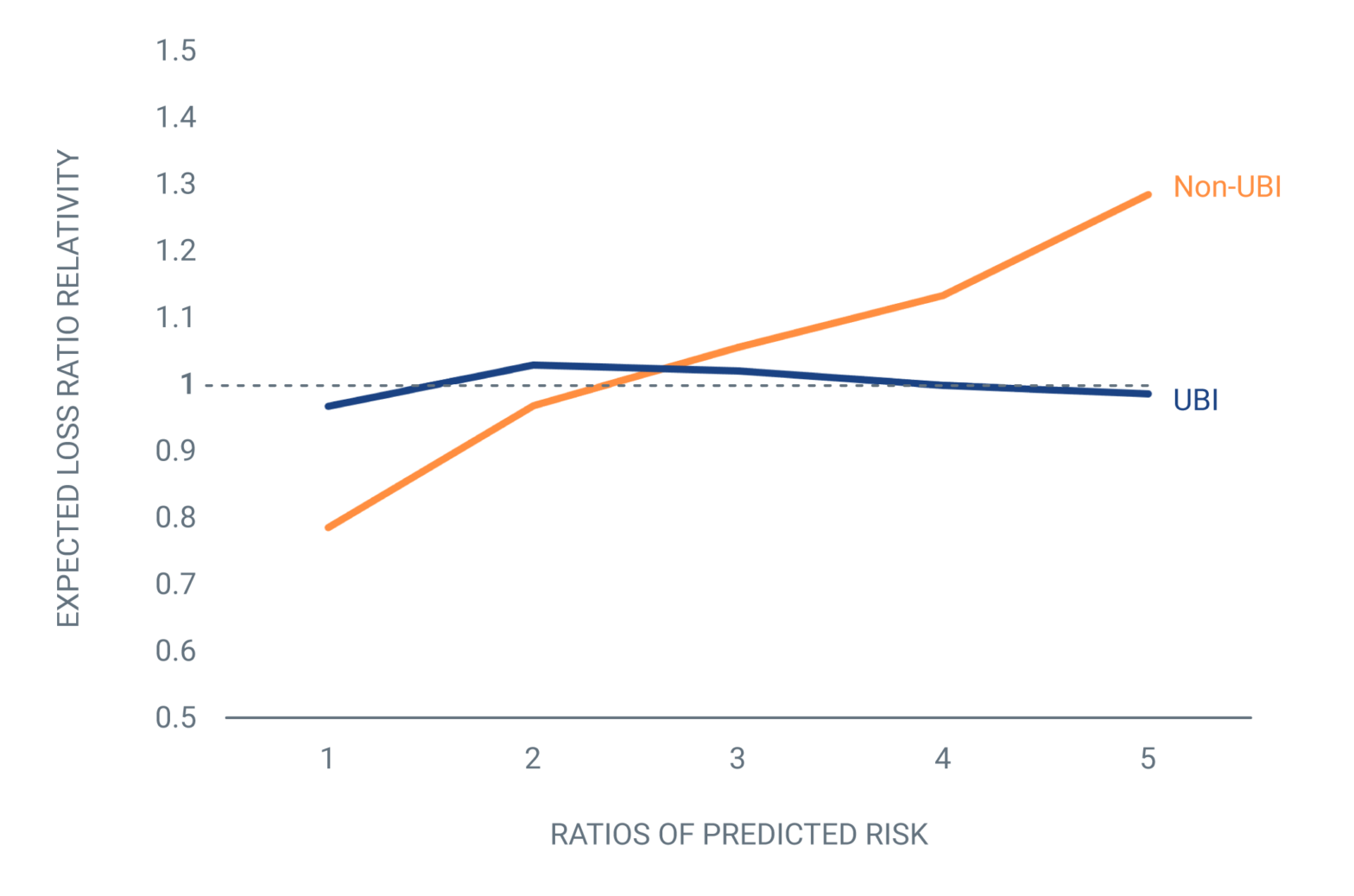

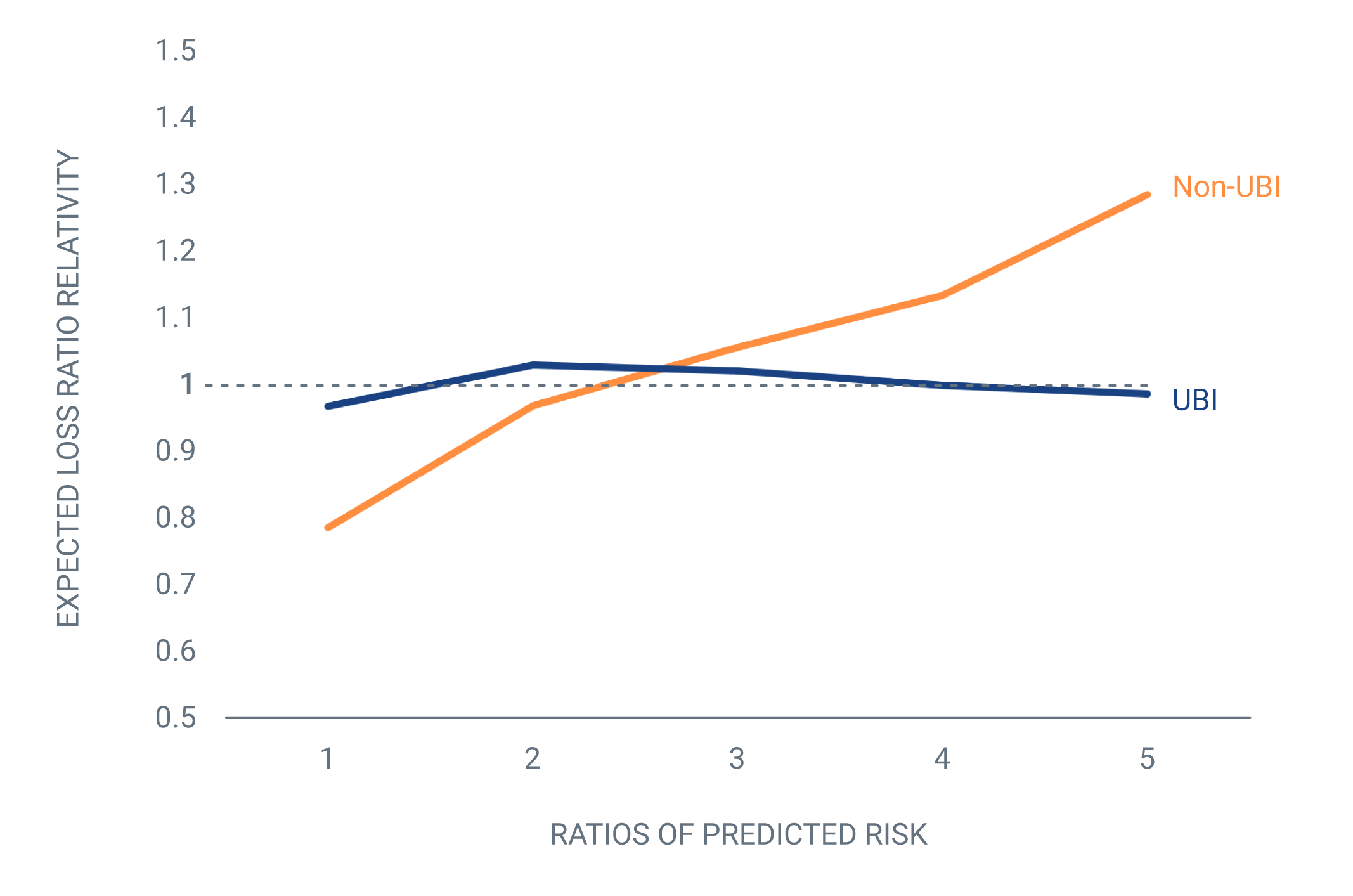

Most insurers agree on the power of telematics in pricing, but how much lift can it provide? The answer is illustrated in the graph below, which is based on our extensive internal analysis. Each line shows the relative expected loss ratio for different levels of driving risk, with one being the safest and five being the riskiest. The orange line (non-UBI) shows how, without including driving risk data, premiums set by auto insurers could unnecessarily penalize safe drivers and potentially underprice high risk drivers.

In other words, when the premium is set too high for safe drivers, the expected loss ratio from that group is naturally lower. Conversely, when premiums are set too low for risky drivers, the expected loss ratio is much higher. What this means is that auto insurers without telematics will lose out to auto insurers whose more sophisticated pricing can help them attract more customers with better rates. Those insurers without telematics are also susceptible to adverse selection because of the inclusion of high-risk drivers in their book of business.

For the blue line, which shows a model using telematics, premiums are more indicative of actual driving risk. The resulting expected loss ratio relativity is therefore consistently closer to one across all the risk levels.

As you can see, telematics plays a key role as auto insurers compete for business. For safe drivers with a risk score of one or two in the above graph, auto insurers can win their business by offering appropriately lower prices. Charging an adequate surcharge for drivers with a risk score of four or five avoids costly losses and minimizes adverse selection. The bottom line is that knowing the actual driving behavior (e.g., speed, braking) or other contextual data (e.g., distracted driving, posted speed limit) allows auto insurers to better understand risk and thus attract the most desirable new business and improve profitability.

Given the prevalence of smartphones and the growth of connected vehicles in the U.S., can any auto insurer afford to not leverage auto insurance telematics to improve profitability or gain a competitive advantage?

For more evidence of telematics benefits, please check out Progressive’s 2022 Q4 earnings call where they discuss their work to retain the least risky drivers and shed riskier drivers with Snapshot.

Given the prevalence of smartphones and the growth of connected vehicles in the U.S., can any auto insurer afford to not leverage auto insurance telematics to improve profitability or gain a competitive advantage?

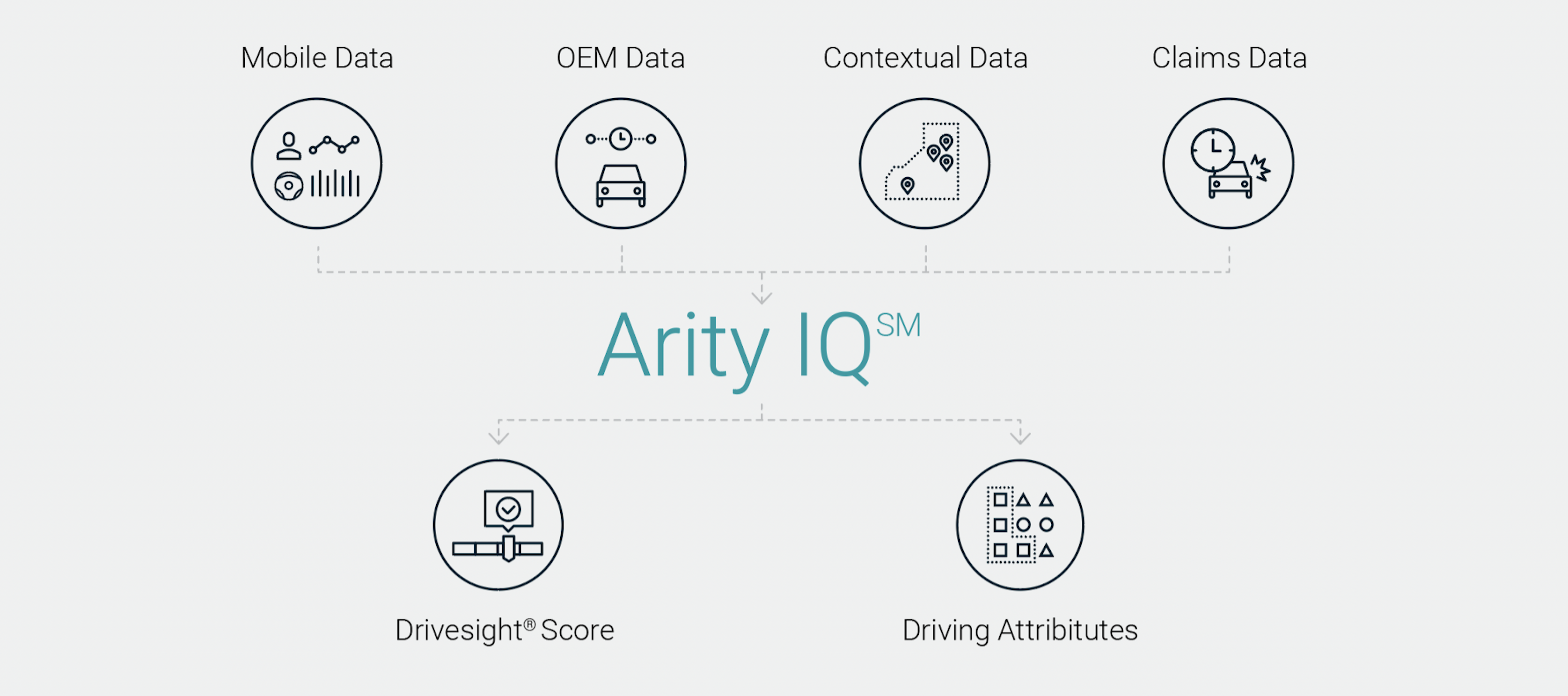

If your existing telematics program has not reached the scale or richness you expected, or if starting a new program from scratch seems daunting, Arity offers a powerful tool to leverage at time of quote: Arity IQ℠. This solution provides auto insurers with actual risk insights on tens of millions of U.S. drivers in real time via REST API. Auto insurers can either choose to receive those insights either via driving attributes or our industry leading driving score, Drivesight®.

With driving attributes such as miles driven, time and day, high speed, hard braking, and distracted driving, auto insurers can further improve the accuracy and scope of their existing traditional telematics model. These attributes are derived from over 1.15 trillion miles of driving data and Arity’s unique insight into what drives loss costs across insurance coverages.

Alternately, auto insurers can choose our industry leading, FCRA-compliant Drivesight®, which uses regression modeling to help determine how to price a customer based on how their driving risk compares to traditional factors. Filed for insurance rating in 48 states plus the District of Columbia, it allows auto insurers to gain immediate insight in real time on tens of millions of US drivers who have provided their consent.

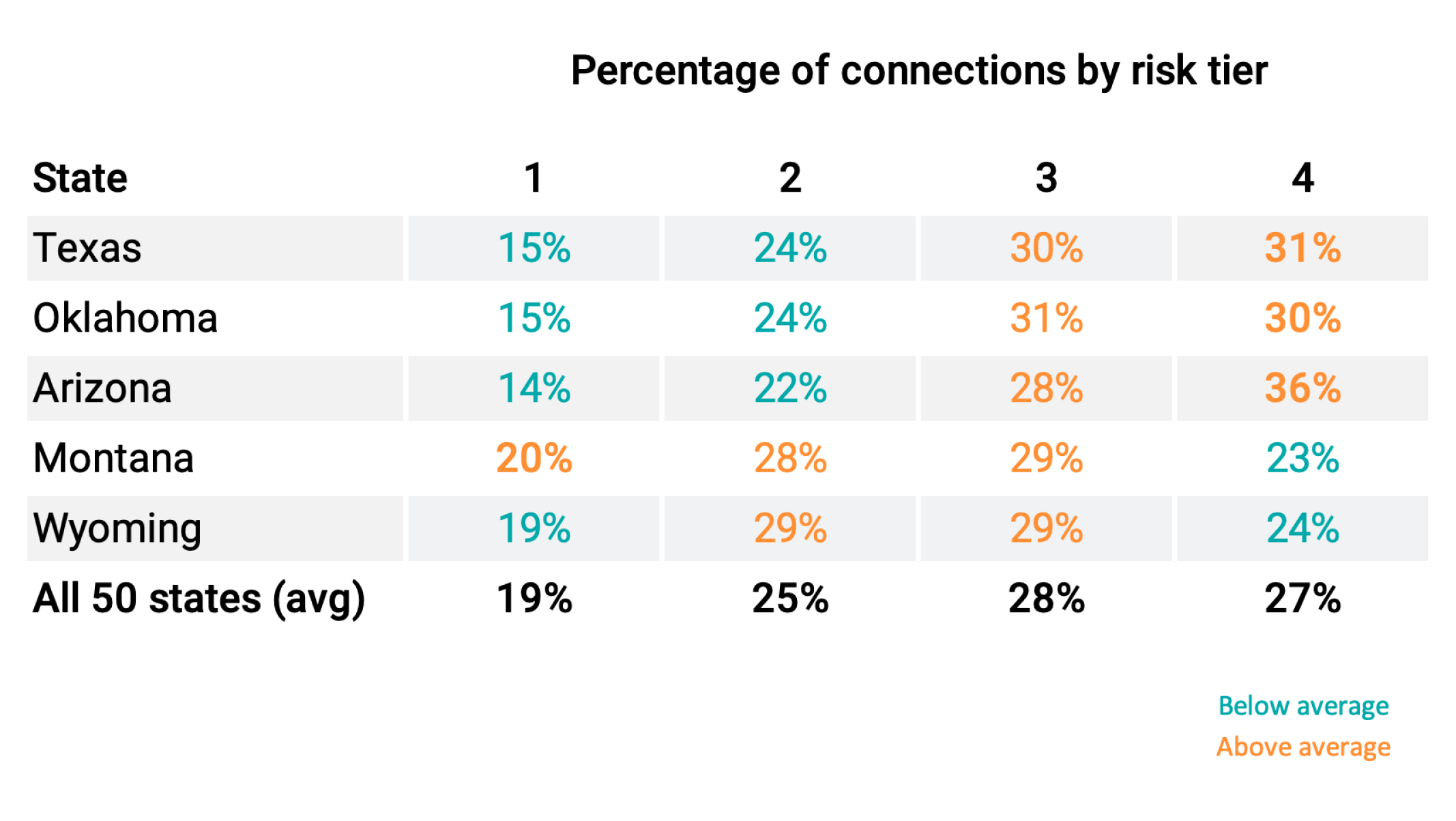

Arity IQ℠ enables auto insurers to enhance pricing sophistication and customer segmentation at time of quote with either Drivesight or attributes. Let us take a look at a hypothetical scenario where an insurer can leverage insight provided by Arity IQ℠ to improve the profitability of the five states shown below.

Based on our latest driving data from these states, Arizona, Oklahoma, and Texas have higher percentages of risky drivers than the national average. Therefore, it’s prudent for this insurer to review their pricing strategy in these states to minimize potential losses. On the other hand, Montana has a higher percentage of safe drivers than the national average, so offering higher discounts there could help attract new prospects and retain existing customers who are safer drivers.

To discover how Arity IQ℠ can help you not only cope with harsh economic challenges, but also thrive in the growing competitive auto insurance industry, please visit the Arity pod during the Insurance Innovators conference in Nashville, Tennessee from April 17 – 18. You will learn the full power of telematics for new business and how it delivers value in underwriting and marketing efficiency.