The 5 Ws (and 1 H) of predictive mobile marketing for fuel retailers Read article

According to an Insider Intelligence survey, 87% of adults prefer to access their bank through a mobile app. This creates a competitive environment for financial institutions as they all strive to boost value for customers by providing the best and most relevant mobile banking features.

Insider Intelligence also reports that users’ most wanted features include:

• security and control

• alerts

• account management

While most mobile banking apps offer these features already, financial institutions could gain a competitive advantage by offering customers more ways to improve financial literacy in their mobile apps.

Mobility data may be a company’s secret weapon. Data about how people move can help companies offer unique experiences on their apps that build trust, increase loyalty, drive engagement – and even boost retention. Mobility data is mutually beneficial for you and your customers; it’s vital to understand your customers’ preferences and patterns, and it helps your customers understand how their behavior might be affecting their wallets.

At Arity, we help companies use driving data to build better products by creating better experiences for their users on and off the road.

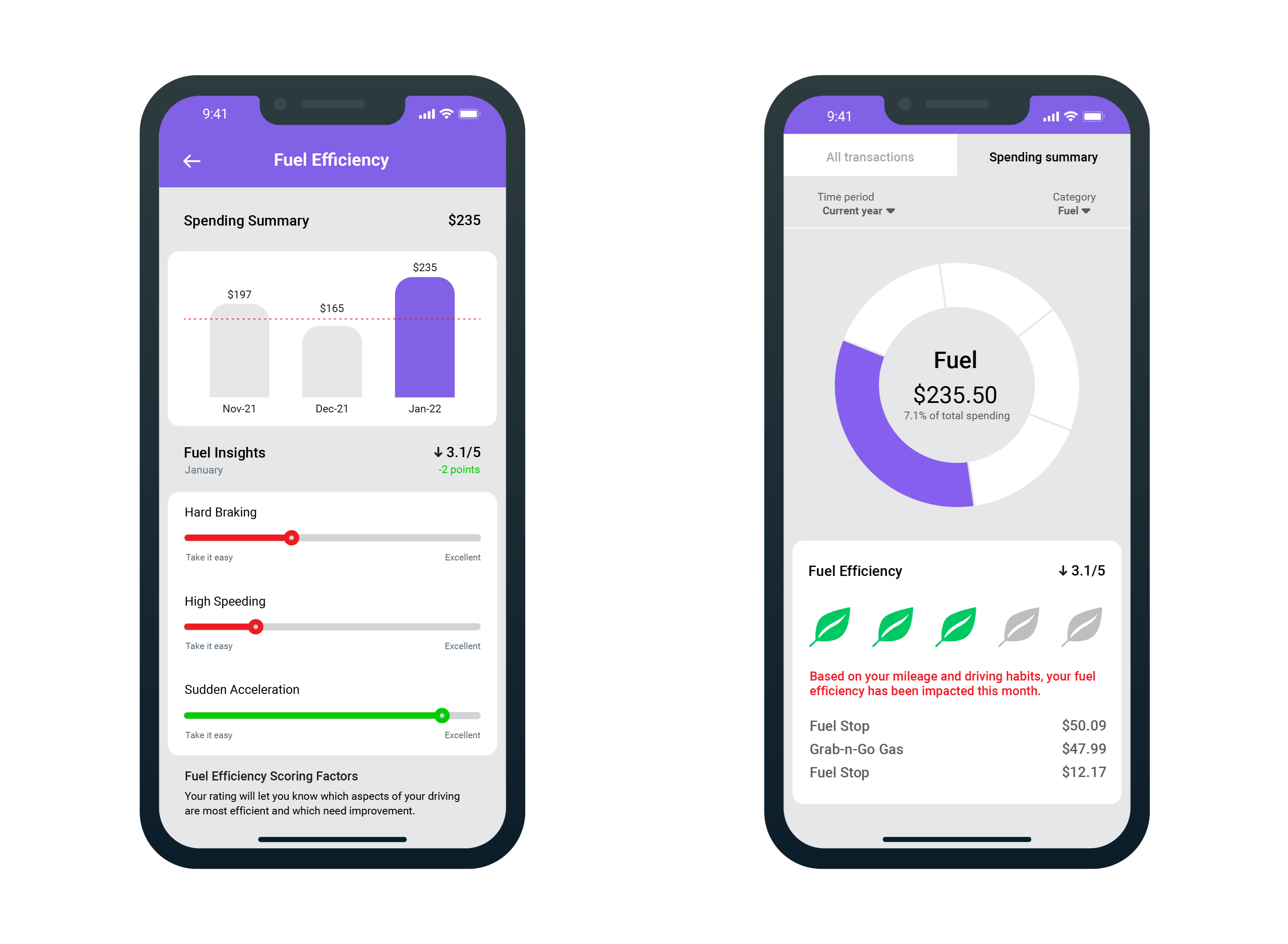

Arity’s mobile app solutions can determine the fuel efficiency score of your users using three different metrics: hard braking, speeding, and acceleration. With this information, you can enhance spending summaries with details about fuel expenses, mileage, and fuel efficiency, along with the other categories your customers already track. In addition, your customers will be able to set ideal spending goals that are personalized to their driving habits and understand how much they could save by being more fuel efficient.

As your customers optimize their fuel efficiency, you can also use their fuel savings to help them save or invest. When customers see how much they’ve saved by driving efficiently, you can encourage them to either transfer that money to their savings account, or even invest it. With the help of mobility data, your app can help users make better financial decisions and manage their money smarter.

There are still many other ways that Arity can help your mobile banking app increase trust, loyalty, and engagement. In the next post, we will share more ways that mobility data can enhance your rewards programs and keep your card top-of-wallet. Connect with us if you’d like to learn more.