Protecting drivers: Auto insurance and the future of mobility Read article

Earlier in 2021, Arity surveyed nearly 2000 U.S. adults to find out how they feel about auto insurance.

With shifting driving behaviors, shopping for new insurance surged in 2020 and many consumers gravitated to big, well-known brands and offers for lower rates. Why? One reason is because inactivity of automobiles left consumers wondering if their rates should drop.

Fast forward to March 2021, a year after the shutdowns began in the US, when we saw auto insurance trends beginning to show a return to the pre-pandemic baseline. Here’s what consumers had to say about their auto insurance policies.

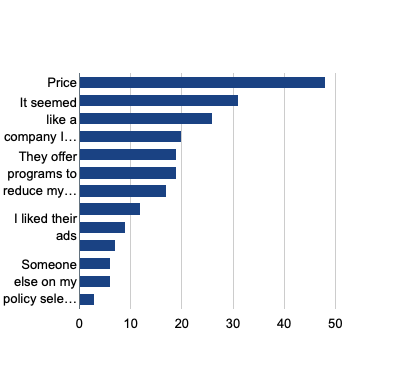

There are many factors for consumers to consider when selecting an auto insurance provider and policy – but none is more important than price. When asking survey participants about the factors most important to selecting their insurance provider, they identified price first, then customer service and perceived trustworthiness:

While the above shows the importance of price on consumer decision making, we wanted to dig a little deeper to better understand what characteristics consumers think they should be priced on.

According to our survey, people appear to have high levels of satisfaction with their insurance company, with 78% being very or extremely satisfied. 47% reported not being dissatisfied with any aspects of their insurance company, and only 22% reported being dissatisfied with the price of their insurance.

Satisfaction doesn’t necessarily mean insurance customers don’t see room for improvement. Our research found that consumers are hungry for insurance pricing tied more closely to how they drive rather than traditional rating variables like credit score or personal characteristics like age and gender.

When we asked which factors should be most important to the price of their insurance, people pointed to:

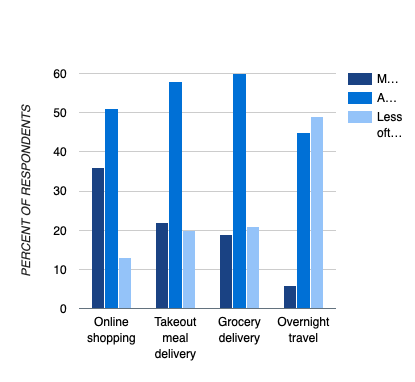

These findings suggest that consumers of auto insurance may be more open to telematics programs that monitor driving behaviors and price policies based on mileage or how safely they drive.

Traditional telematics programs generally offer customers a participation discount followed by potential additional discounts at renewal – based on safe driving behaviors like speeding, distracted driving, hard braking, and more. Other telematics programs are based specifically on miles driven, with how much someone drives having the biggest impact on premium. Both of these programs give consumers more control over the price they pay for insurance – but although each of the top-10 auto insurance carriers now offer a telematics program, it’s estimated that countrywide adoption remains under 10% of carriers’ current books of business.

It’s not for a lack of interest in telematics programs.

Instead, consumers identified many barriers to entry with traditional telematics programs, including:

Accounting for these consumer concerns, insurance carriers need to discover innovative ways to leverage telematics on a greater percentage of their books of business. After all, actual driving data is the most predictive measure of driving risk.

Traditional telematics programs are a great option for some consumers, but not all. For some, these programs may come off as too intrusive and uncertain – because of the level of engagement they require. There is also an enrollment process – which adds an easily forgotten step and some see as a downright hassle.

Now, insurance carriers can reap the benefits of telematics data on a larger percentage of their book of business, without relying on consumers to enroll in their telematics program first. Using Arity IQ, insurance carriers can price tens of millions of drivers at new business using already-collected driving behavior insights – allowing insurers to price all segments of risk more accurately and grow profitably.