Driving change with driving data

Mobility data and insights to power your business

The largest driving behavior dataset tied to insurance claims

Driving behavior insights on over 30M drivers

Over one trillion miles of driving data

PRODUCT UPDATE

Arity Marketing Solutions

Introducing the newly enhanced Arity Marketing Solutions:

Arity has joined forces with Transparent.ly and LeadCloud to offer an enhanced suite of marketing solutions to help companies boost profitability and productivity.

Enterprise-scale solutions for insurers

Marketing and advertising

Reach your best customers based on how, when, and where they drive

Public sector

Near real-time driving insights to improve infrastructure and safety

Mobile apps

Generate more engagement and revenue

Mobility data solutions for your industry

Auto insurance

Price based on actual driving behavior

Marketing and advertising

Advertise personalized offers to consumers

Mobile apps

Increase customer engagement

Public sector

Increase road safety

One trillion miles of driving data collected

Trusted by companies large and small

What people are saying about us

Arity IQ℠

Driving data delivered on demand

Arity Audiences

Target drivers based on risk, mileage, commuting habits, and more

Crash Detection

Ensure your users get help when they need it most

Mobile Telematics Experiences

Telematics, customized for your business

White paper

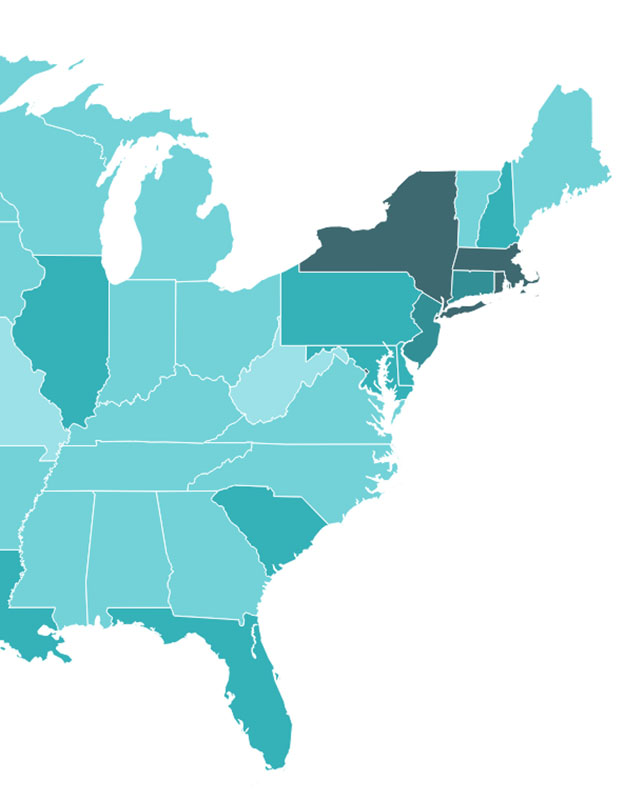

Crash course: The state of distracted driving in the U.S.

Distracted driving has increased 30% over the last four years. Where and when is it at its worst?

Distracted driving is a national concern, but the average frequency of distracted driving varies not just state by state but even down to the county and zip code.

News & insights

blog post

Traffic takeaways: The Baltimore bridge collapse

How did the Francis Scott Key Bridge collapse impact Baltimore’s traffic patterns?

blog post

A continuing concern: Distracted driving has increased, again

Distracted driving has increased more than 30% over the past five years. What does this mean for risk on our roads?

blog post

Game day recap: Tackling driving stats from the big game

Game day driving behavior stats from 2022 – 2024.

news

Traffic deaths rose 30% in the past 10 years. Here’s what it will…

Arity's president says that our transportation system is broken, and it’s incurring a significant human cost.

Fast Company